Trent Ltd : Hiding in Plain Sight

Persistent High PE, yet sustained Wealth Creation - Rare Combination

Trent has been a great value creator over the last 2 decades in the most brutal industry where survival probability is low & sustainable wealth creation is even lower.

Let’s understand the history first.1

Lakmé is an Indian cosmetics brand, currently owned by Hindustan Unilever. It was named after the French opera Lakmé, which itself is the French word for goddess Lakshmi who is renowned for her beauty.

Wait, why are we talking about Lakmé & not Trent. Trust me, we will there.

Lakmé started in 1952 as a 100% subsidiary of Tata Oil Mills (TOMCO), famously after Prime Minister Jawaharlal Nehru was concerned that Indian women were spending precious foreign exchange on beauty products and persuaded JRD Tata to manufacture them in India. Behind every successful company there are women who can’t get enough cosmetics.

Initially it was called Lakshmi beauty products later rebranded it to Lakmé and Simone Tata joined the company as director and went on to become the chairperson. However, in 1993, TOMCO merged with Hindustan Unilever (erstwhile Hindustan Lever) in a strategic deal. Subsequently, in 1996, Lakmé formed a 50:50 joint venture with Hindustan Unilever, and in 1998, Lakmé divested its 50 percent stake in the joint venture and sold its brands to Hindustan Unilever for ₹200 crore (US$48.46 million).

The reason behind the sale was that Tata saw a greater growth potential in retailing, and believed that it would be much more difficult for an Indian company to release new cosmetic products in a market that had opened up to global companies.

Trent (Tata Retail ENTerprise) was born & the rest is history.

Trent share price has compounded by ~25 % CAGR since 1999 to 2023.

But many investors (both retail & professional) didn’t participate in this journey & one major reason was “high valuation”.

This is Trent’s PE ratio plotted against time. The median ratio is 140x. The blank parts represent infinite ( as earnings were negative ).

For example, in Aug 2015 if you had invested at 150x PE ( Rs. 130 ) you would made a cool 15x till Aug 2023 with an ending PE multiple of 150x. Thats 35% CAGR. So, maybe 150 PE was not expensive in 2015.

We had interacted with many Fund Managers & Analyst’s in our community, & most of them said it was over-valued & hence didn’t go deeper.

What most of the people failed to see is that Trent has many formats & some of them (Zudio, Utsa, Booker & Star Bazaar) were in a nascent stage & were making losses. This is very common in retail since these formats were envisaged to make profit after it reaches a certain store count / revenue base. The problem with PE ratio is that the losses from these new formats get set-off with the profits from profitable formats like Westside & Zara (JV). Hence, the “E” in PE get mis-represented which optically over states the PE ratio.

Problem with PE for such businesses is that we are assigning negative value to Zudio (-100 * 100 = -Rs. 10,000) & Star Bazaar (-50 * 100 = -Rs. 5,000). However, these businesses are not expected to remain loss making forever. There will be 2 scenarios -

These formats will turnaround & become successful like Westside.

Trent is not able to turnaround these formats & finally closes them.

In both the scenarios the value of the younger businesses will exceed the negative value in the table.

In the same example, lets now assume the earnings of Zudio & Star to be Zero.

The PE Ratio drops to 50x from 100x

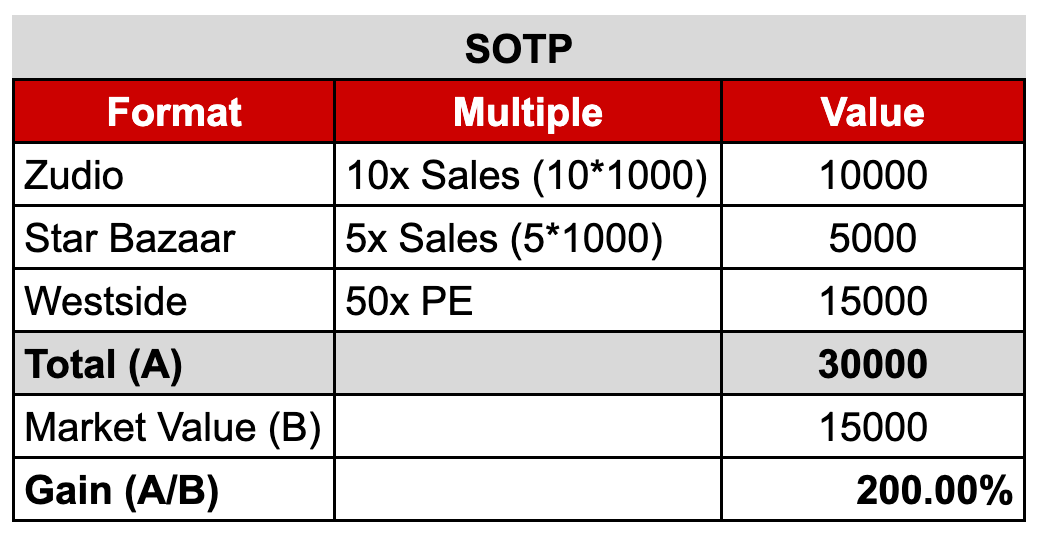

Now lets assign a Market Value to Zudio & Star based on a Sales Multiple using SOTP (Some of the Parts).

Now the Total Value of the business turns out to be 2x of 15,000. SOTP makes sense when valuing different businesses in the same company or when businesses are in nascent stages & are reporting temporary losses.

One reason why we should stay invested over the long run even if businesses get expensive is due to the asymmetric payoff structure, the max one can lose 100%, but the max one gain is infinite. Also, by selecting good businesses + good managements we can reduce the risk of losing 100%, thereby improving the asymmetric payoff structure further.

For instance, Zudio has come a long way which was once part of Star Bazaar JV & was acquired by Trent in 2018.

Fast-forward now, Zudio is expected to do more than Rs. 6000 cr in FY24.

Problem with PE ratio is that one number can never do justice to a great company in a dynamic business environment where there are too many moving parts. One acquisition or a good business decision can put you in a new orbit.

Summary -

https://twitter.com/pro_nirmiti/status/1692425192801481172

Reference - https://www.tatacentralarchives.com/tata-legacy/lakmes-history.html