At Proinvest Nirmiti, our research team believes that investors should view businesses as a moving picture rather than a static one.

The problem with assigning a Target Price is that one will have a constrained view & ignore the dynamic nature of a business such as mergers & acquisitions, strategic partnerships, deleveraging or re-leveraging, improved capital allocation - Buybacks (tax efficient), entering into newer product segments or geographies etc.

In the long run, these factors matter too and are equally important compared to the financial numbers reported by the company. These factors create a positive perception change which in turn drives the valuation.

A classic example is Bajaj Finance, which started as an Auto Finance company for Bajaj Auto, entered into newer consumer segments like Personal Loans, EMI cards, Housing Loans & now with the launch of its Marketplace it's considered as a Fintech company or Tech-Enabled Lending Platform. This just shows that rather than fixating on the Price, if one could simply understand the business & the way it's scaling up, it would do more justice to both the business & the investor. In short, the Journey is more important than the Destination.

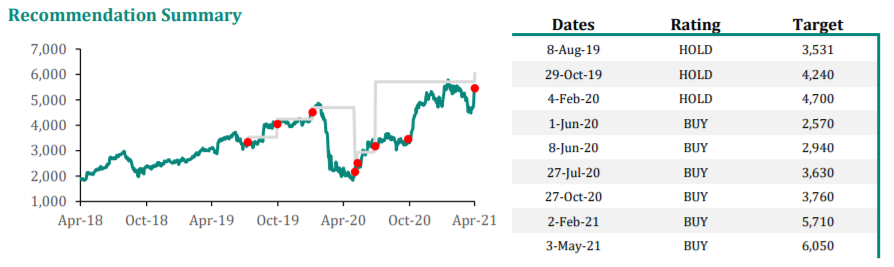

(Target Price & Rating of Bajaj Finance by a Domestic Broker for the past 1 year)

For Sell-Side research, they have to give a Target Price as it helps them “sell” the report. It becomes a talking point in the media & among the analyst community. For instance, Bernstein downgraded Bajaj Finance to underperform with a target price of Rs 1740 when the stock started falling during the pandemic. After the stock recovered, they came out with a Buy rating with a target price of Rs. 7240 in Jan 2021.

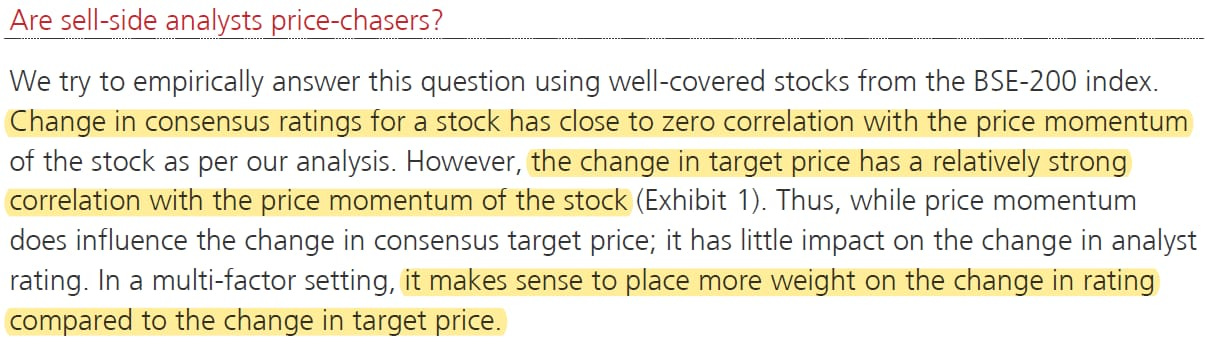

Also, in general most of the research firms increase or decrease the Target Price based on the change in the stock price. We are not the only ones saying this. Even some of the prominent Sell-Side research firms agree with us on this.

Here is a leading domestic equity research firm answering one of the most controversial questions.

"Are sell-side analysts price-chasers?"

Conclusion - Your rationale about the business matters the most. Selling a great business just because the target price is achieved is like cutting the flowers & watering the weeds.

Proinvest Nirmiti Research Desk

Disclaimer– Proinvest Nirmiti is a SEBI Registered Investment Advisor INA000013305. We may have positions in the above mentioned companies in our own & in our client's holdings. This newsletter is for educational purposes & should not be construed as investment advice. Please consult your financial advisor before making any investment decisions.