Muthoot Finance - When Life Throws Tight Loans at You, Turn Gold into Opportunity !

All that glitters is GOLD!

Before jumping into Muthoot Finance, let’s take a step back and understand why gold loans are in strong demand.

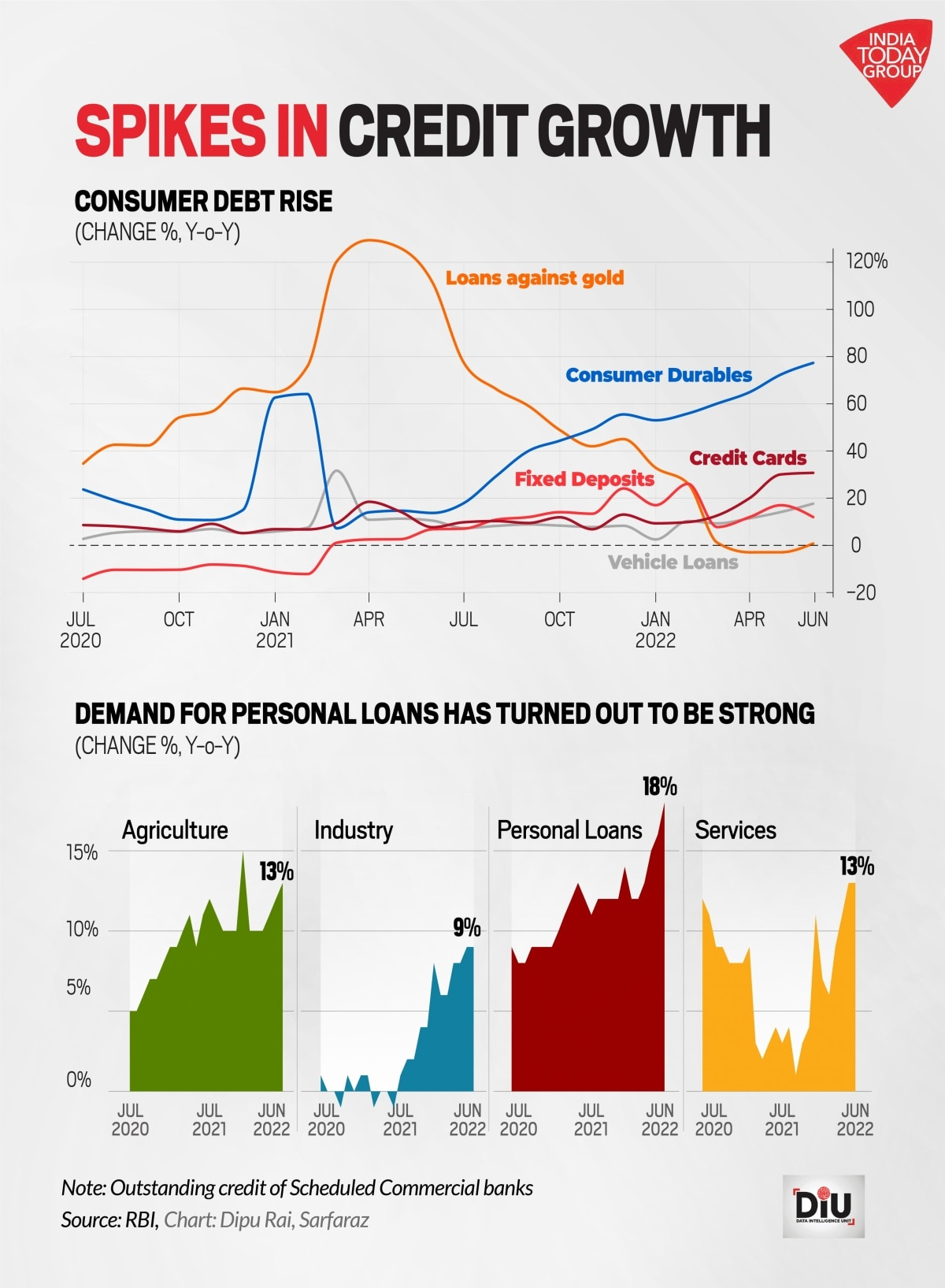

Post-COVID Financial Trends: A Surge in Unsecured Loans

The post-COVID era witnessed a significant rise in unsecured loans, particularly small personal loans and credit cards. Fintech companies played a transformative role, simplifying loan approvals and enhancing access to credit. Low debt levels among retail borrowers at the start of the pandemic created fertile ground for banks, NBFCs, and fintech's to expand their portfolios.

A report by CRIF and the Digital Lenders Association of India highlighted a dramatic growth in outstanding personal loans, which more than doubled from ₹5.5 trillion in FY20 to ₹11.9 trillion by H1FY24. However, this rapid expansion drew scrutiny.

The RBI Sounded the Alarm 🚨

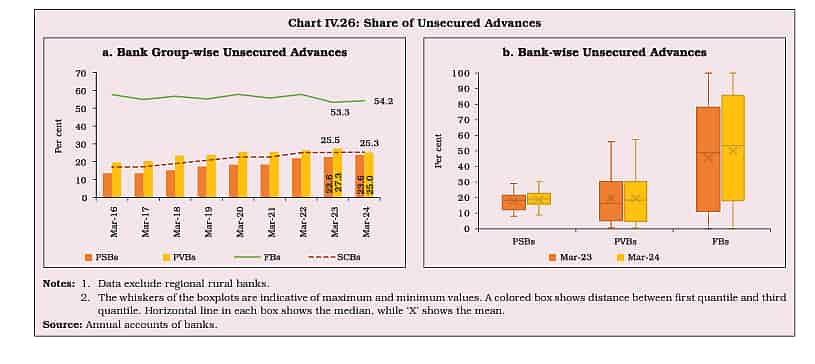

The RBI has raised concerns over the risks posed by unsecured loans, which surged by 25.5% ⬆️ as of March 2023. While public sector banks have exercised caution in extending unsecured credit, foreign banks reported the highest exposure, followed by private sector lenders, according to the RBI data.

In response to rising concerns over excessive debt accumulation, the Reserve Bank of India (RBI) introduced tighter regulations for unsecured loans. Financial institutions were urged to adopt stricter approval criteria, and the RBI raised risk weights on unsecured loans and bank loans to NBFCs ( in short they made these loans more expensive for banks). These measures led to a marked sharp decline in consumer loan growth from 23.3% in November 2023 to 13.9% by June 2024.

Brakes on Unsecured Loans? - The Rise of Gold-Backed Lending:

Even with the brakes on unsecured lending, retail borrowers hungry for quick, small-sized loans aren’t slowing down. So where will the supply come from if unsecured lending has to take a back seat?

→ It will come from lenders who take full collateral against loaned amounts. And no one better than Gold lenders like Muthoot Finance to take up the slack.

But what made Loan against Gold favourable?

Gold prices in the last year have risen by almost 25%. This allows borrowers to borrow more against the same weight of Gold. Existing borrowers even avail top ups. NBFCs maintained their dominance in loans against the pledge of gold ornaments and jewelry, with a share of 59.9% of total gold loans (banks and NBFCs together).

Despite this increase, it’s essential to note that the gold loan market size is just 10% of the personal loan market, with Rs 1.47 lakh crore in gold loans compared to Rs 14.27 lakh crore in personal loans.

Muthoot Finance Golden Leap -

Muthoot Finance holds 44% market share in the gold loan segment. Being the largest player it was very obvious that the company will benefit from growth shifting towards Gold Loans.

Muthoot Finance wasn’t going to let this opportunity go. From September 2023 to September 2024, the Gold AUM for Muthoot grew from Rs. 67,500 crore to Rs. 86,200 crore, an impressive growth of 27% in a year. H1FY25 saw the company disburse its highest-ever gold loans to new customers, at Rs 10,687 crore to 9.66 lakh customers. Among the peer NBFC group, Muthoot Finance has the highest average gold loan AUM per branch, at Rs 17.75 crore.

After Q2FY25, seeing the strong demand, the company increased its growth guidance for the financial year from 15% to 25%. While NPAs have also increased to 4.3% but all of that is against secured loans. In Q1FY25 and Q2FY25, the number of loan accounts increased sequentially by 5% and 6% respectively. Before this, the growth was restricted to 1% or 2% every quarter. This is also evident from the sharp rise in disbursements and collections.

Muthoot has been very judicious in the use of capital. It raised equity capital once in 2015 amounting to INR 420 crore. Since then the balance sheet of the company has become 4x. Return on equity has been very impressive. Despite NIMs falling in the last two years Muthoot was able to hold on to its profitability and then was ready to make big bucks when opportunity presented itself.

Do you Know ?

As of January 2025, Muthoot Finance Ltd. held nearly 200 tonnes of gold in its vaults. This is more than Pakistan or Singapore or Thailand Gold reserves.

India is the second largest jewellery consuming nation in the world.

Competitive Landscape and Regulatory Challenges -

While Muthoot maintained its leadership, competitors like IIFL Finance and Manappuram Finance faced regulatory challenges. IIFL Finance experienced a temporary suspension of gold lending operations due to concerns over gold purity assessments and loan-to-value breaches, while Manappuram’s subsidiary, Asirvad Micro Finance, was directed to halt new loans. These disruptions impacted their performance, underscoring the importance of regulatory compliance.

Thus, one will have to be cautious about RBI’s actions on Gold Lenders too. It has directed the financial institutions to consider the borrower's capacity to repay and not only rely on collateral value.

A Glimpse into the Future -

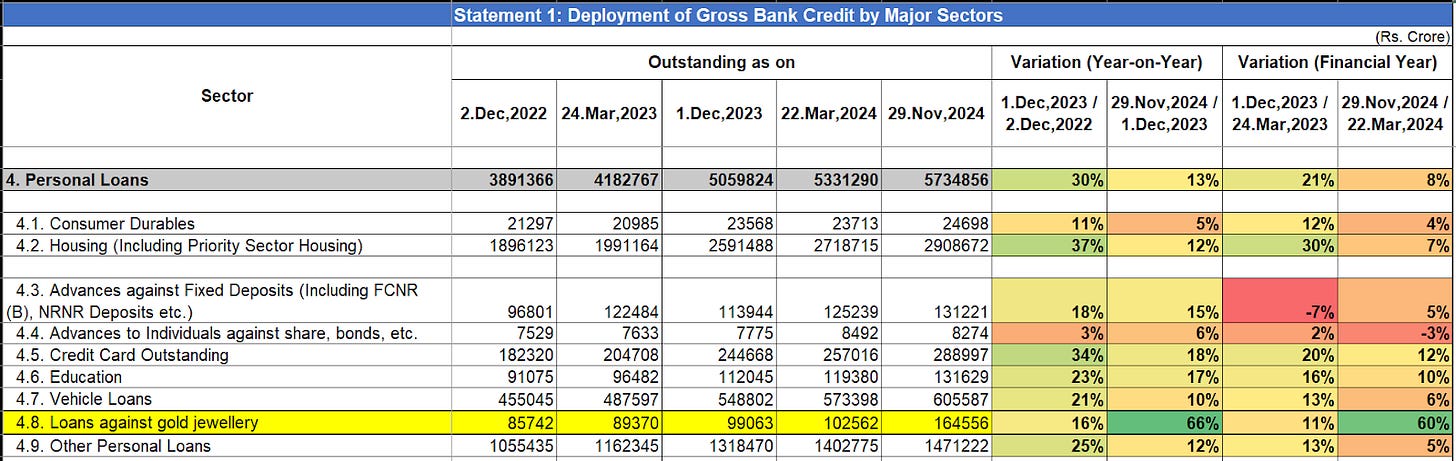

The below picture is sectoral deployment of credit by banks - a report published by the RBI every month.

From the above image, one can clearly see that the Personal loan which grew by 30% in Dec 2022 to Dec 2023 has slowed down to 13% in the following year. The same is the case with Credit card loans, which are down from 34% to 18% in Nov 2024.

On the other hand, Loan against gold jumped from 16% growth in Dec 2023 to 66% in Nov 2024.

This report clearly highlighted that growth in unsecured lending such as personal loans and credit cards by banks is slowing and that in gold lending is upwards of 50%. One can make an estimate of the growth ahead from these numbers.

This trend positions Muthoot Finance to benefit substantially from shifting market dynamics.

Conclusion -

Shift in Lending Trends – The post-COVID surge in unsecured lending is slowing due to regulatory restrictions, making gold-backed loans a preferred alternative.

Muthoot Finance’s Advantage – As the market leader with a 44% share in gold loans, Muthoot Finance has capitalized on this shift, witnessing a 27% growth in its Gold AUM.

Rising Gold Prices Boost Lending – The increase in gold prices has enabled higher loan amounts against the same gold weight, further driving demand for gold loans.

Regulatory Challenges for Competitors – Rivals like IIFL Finance and Manappuram Finance have faced regulatory hurdles, allowing Muthoot to strengthen its market position.

Sustained Growth Prospects – The sharp rise in gold loan growth (66% in Nov 2024) compared to the decline in unsecured lending indicates a strong future for Muthoot Finance.

Opportunity for Muthoot – While Muthoot Finance has leveraged the opportunity well, future growth will depend on RBI’s evolving stance on gold-backed lending. As the financial landscape evolves, gold-backed lending continues to emerge as a resilient and reliable financing solution. Focusing on companies which are thorough with compliance is better in the long run. They always make themselves available to industry tailwinds.

Subscribe so that you never miss our next Idea