A New Beginning: Entering Healthcare

Abhay Soi, the hospital Mogul worked as a turnaround specialist in his earlier avatar, helping struggling companies regain their footing. He started his career at the erstwhile Arthur Andersen and later worked for EY and KPMG as head of financial restructuring. He is a first generation entrepreneur and has now become a big name in healthcare care due to his savvy deal making. He has successfully scaled the business from one hospital with operations and management mandate to now 19 hospitals with over 4000 beds. This all while using capital prudently. Let’s study his rise from 2010.

In 2010, when B L Kapoor Hospital in Delhi became available for operations and management, Abhay Soi recognized a promising opportunity. Despite having no prior experience in healthcare, he entered the industry with determination. With financial support in the form of a loan from J.P. Morgan, Abhay Soi aimed to acquire a stake in the company that was already managing the hospital at book value and renamed it Radiant Life Care, believing he could successfully revitalise it. If that didn’t work out, he planned to sell it in a couple of years. However, he succeeded in turning around the hospital, making a sale unnecessary.

Fast forward to 2014: Radiant Life Care was on a roll! They entered an Operations and Management contract with Nanavati Hospital, which was in its own pickle. Abhay Soi was at the helm again, and he pulled off another successful turnaround, proving he had the Midas touch in healthcare.

Soi brought Pramod Lele, former chief executive of Hinduja Hospital. He further on-boarded 40 other top professionals. Brought in efficiency by reducing workforce, managing indirect costs. He changed the type of surgeries done to increase average revenue per bed and focused on medical tourism.

Seizing the Opportunity: The Max Healthcare Takeover

2018-19 brought another opportunity for Radiant Life Care, to acquire Max Healthcare with 10 operational hospitals. The promoters were looking to exit. By 2018, Soi’s two hospitals under his company Radiant Life Care were generating INR 110 crore in EBITDA while Max with 10 hospitals was having an EBITDA of INR 212 crore.

KKR, the private equity giant, joined Abhay Soi in this takeover. Now, it was time to turn around Max’s 12 hospitals. The same playbook used for B L Kapoor and Nanavati was to be used but on a much larger scale and all at once. Abhay Soi was of the opinion that Max had hospitals in prime locations and good brand name, if efficiencies are brought into, turnaround could be achieved. And Max Healthcare achieved it within a short span of time.

KKR had purchased 49% for $200 million in Soi’s Radiant Life Care in 2017. They funded the upfront purchase of Life Healthcare’s 49% stake in Max Healthcare. Max’s Senior Living and Insurance Business were demerged and listed separately. Later, Radiant Life was merged with Max Healthcare Institute and shareholders of Radiant Life Care KKR and Abhay Soi received shares of Max Healthcare and it got listed.

The Transformation :

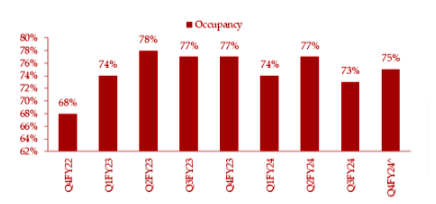

Max Healthcare worked to improve contribution to its revenue from complex procedures in Oncology, Liver Transplant etc. There is lesser competition in these segments and they offer higher Average Revenue per Operating Bed (ARPOB). In FY 2017-18, that is just before acquisition, Max’s contribution from Oncology was 18%. By FY 23, it is 24% and on a higher revenue base. The Company also improved its occupancy. Prime location in Tier-1 cities aids in achieving high occupancy. Currently, it is the highest in industry and new capacity gets utilised quickly.

Doctor payout and employee costs were rationalised. In FY 20, the professional fees and consultant fees including doctor payout were 22.61% of the revenue whereas in FY 24 the same were 20.64% of the revenue. Similarly employee costs were 23.83% in FY20 whereas those were 17.28% in FY24. Abhay and his team at Max have successfully achieved efficiencies which were eluding Max Healthcare Institute till it was taken over.

Payor mix has improved significantly. Share of International and Insurance patients has increased and has almost doubled in the last four years. Institutional Mix has reduced which is prone to late payments and lower ARPOB.

Soi Effect :

Max Healthcare had all the right elements for success: prime locations, a robust network of doctors, strong brand recognition, and top-notch infrastructure. However, despite these advantages, it was under performing. The turning point came with the appointment of Abhay Soi, a hands-on executive with a clear vision and strategic mindset. Under his leadership, Max Healthcare not only improved its financial performance but also solidified its reputation as a leader in the healthcare sector. The combination of strategic vision and execution transformed the company, enabling it to reach its full potential and better serve its patients.

Abhay Soi's arrival in the hospital industry marked a turning point, as his innovative approach and strong execution transformed existing practices. Recognizing the untapped potential within the industry's assets, he implemented strategic changes that emphasised efficiency and patient care. Sometimes, an outsider’s view and execution is what is needed for an industry to start performing and churning profits. Abhay's impact was not just significant; it was a catalyst for widespread change in the healthcare landscape.