Before jumping into CARE RATING, let me explain why the rating industry is so damn lucrative.

I find many similarities here with Buffet's “See's Candies” - a cash generating machine, which grows without requiring any incremental capital investment.

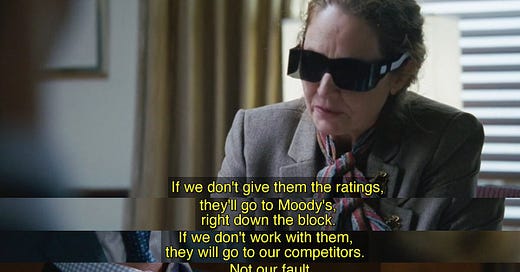

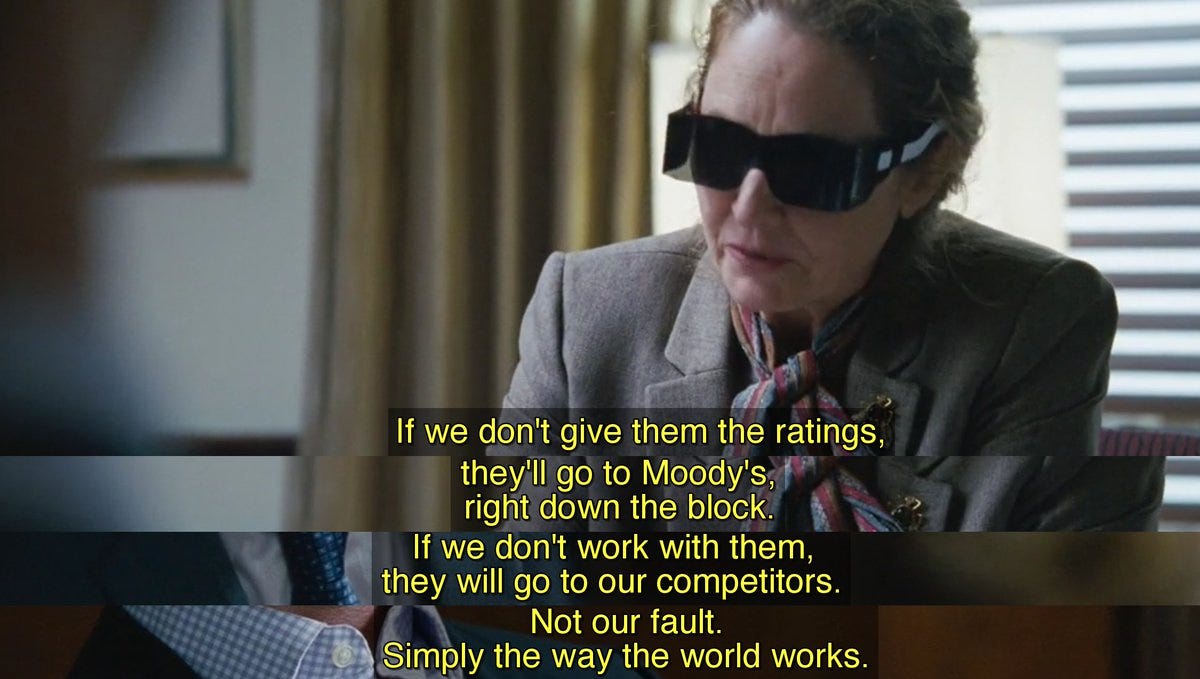

This scene is from the famous movie The Big Short , a must watch movie. It has helped me to build a practical perspective regarding credit rating agencies → they are a necessary EVIL

The way the modern monetary policy works, the output remains constant - money supply keeps on increasing no matter what. The can gets kicked down the road every time. At the end of the day money printed is technically adding more debt. More debt means more business for Credit Rating Agencies (CRA). The way I think about CRAs is that they operate as a toll collector on fixed income instruments.

This business requires very little capital. It's just some people (credit analysts) giving their opinion (cough cough) in a pdf format which corporates require while issuing new debt + maintaining old debt & investors have become used to accepting ratings only from the top 3 CRA. Globally, this sector is controlled around 3 players - Moody’s, S&P & Fitch Ratings. In India we have Crisil, Care & ICRA which control 90%.

The entry barrier is sky high here. For instance let’s say our firm -Proinvest Nirmiti decides to enter this business thinking how hard it would be (the job isn’t, the business is). We have a couple of research analysts who we call credit analysts from tomorrow. Let’s assume we find a corporation XYZ who wants to raise Rs. 50 cr by issuing bonds to investors. Our newly promoted credit analysts study this corporation & come out with a credit report, hardly a 2 day job to make a 5 page pdf report. Now starts the problem, why would the investors accept our rating? The industry has been built in such a way that only ratings issued by the top 3 CRAs are accepted, anything else is difficult to digest for them. Many funds have mandates & and accept a specific rating from the top 3 CRAs. They have created terms like Investment Grade & Junk Bonds on the ratings grade they assign. In short they have created their own language of ABCD… which is AAA, AA, A, BBB …. & they discourage new CRAs to fit their comparable grading scale amongst them

Coming to the debt issuer ( corporation XYZ), the only logical reason they would allow us to rate their debt is if we offer a lower fee for our service. But, the problem here is that they will have to offer a higher yield. Below is an example of how debt rated by Moody’s helps the issuer reduce their finance cost. The finance costs saving by using Moody’s services are higher than what they pay as fees to Moody’s. In short, a winn=-win for Moody’s & Corporation XYZ.

Because of the strong network effect, it is extremely difficult for competitors to enter this industry. Also, the profit pool is not very large to attract competition.

Over the past 100 years (yes its an old industry & Moody’s started its business by rating Railway bonds in USA) the top 3 players have built a huge mind share such that they have become indispensable. Top 3 CRAs despite being the major culprit in the 2008 housing crisis, they still are the same ones having more than 90% market share after 14 years. Some things never change.

Coming to CARE Rating, around 90% of their business comes from Rating services vs just 25% for CRISIL (S&P subsidiary) & 50% for ICRA ( Moody’s subsidiary). The remaining businesses are KPO type businesses where the moat is not very wide. However, CRISIL & ICRA also provide outsourced services to their parent which increases their opportunity size vs CARE which has mostly domestic operations.

CARE RATING has the highest EBITDA margin among the 3 players in India due to superior business mix. Although CARE is trying to diversify its business (which we don’t like TBH, as the incremental RoCE will be much lower), we still think it's a great business to own. CRISIL & ICRA being MNCs, have always traded at a premium. CARE had some corporate governance issues in the past, but they seem to have put that behind them & have also rebranded their corporate identity to CARE EDGE.

CARE has a lot of room to further improve their EBITDA margins. Between 2013-18 they had margins north of 60% vs around 35% now. Given high fixed costs (majorly employee costs), we can expect massive operating leverage as scale increases.

Given the geopolitical scenario we think that it is extremely important for India to have at least one domestic CRA. Hence, we believe that it is also in the best interest of the Indian government to make sure that CARE does well.

On a concluding note, it is very difficult to find an industry where all the players are making RoCE’s way above cost of capital, require no re-investment for growth & competition can’t enter easily. In such industry dynamics, companies actually don’t compete with each other, rather work in sync & keep on raising prices each year & make sure the industry profit pool doesn’t shrink.

'The way the modern monetary policy works, the output remains constant - money supply keeps on increasing no matter what. The can gets kicked down the road every time. At the end of the day money printed is technically adding more debt. More debt means more business for Credit Rating Agencies (CRA). '

I dont think that the above is the primary factor for Indian CRAs. Anyways, Indian money supply has not grown too much. Rather, my way of looking at things is that the number of listed companies is growing rapidly, thus the TAM for CRAs is growing rapidly. I bought in a couple of years ago when Care went down for temporary issues.