Before getting into why we think BSE is on a cusp of a multi year earnings cycle, let’s look at the history of BSE.

History

BSE Ltd was established in 1875 by Premchand Roychand, a cotton merchant as ‘Bombay Stock Exchange’. It is the oldest exchange in Asia and seventh largest in the world.

For more than a century, BSE had complete dominance over stock trading in India. After the Harshad Mehta Scam, to break this monopoly and improve transparency in the capital market, the government of the day decided to create the NSE. It was India’s first computer-driven stock exchange and was promoted by some of the leading financial institutions at that time.

NSE’s Dominance

NSE was given the right to set up trading terminals across the country, while BSE was not allowed to do so. As a result, NSE was able to capture market share from BSE and thus started NSE’s dominance.

Even in the derivatives market, NSE took the lead and cornered the market with more than 90% market share. BSE struggled to make inroads in derivatives despite numerous attempts.

BSE’s wake up call

Post Covid, there has been significant change in the profile of participants in the derivatives market. The market has deepened. More retail and proprietary traders are participating in trading activities. Expiry day trading has caught the imagination of everyone. Taking advantage of this, BSE relaunched its Sensex and Bankex options in Q1 FY24. It has kept the expiry of these two indices on days different from those of NSE’s. This enables traders to have enough liquidity to take positions in BSE derivatives on expiry day.

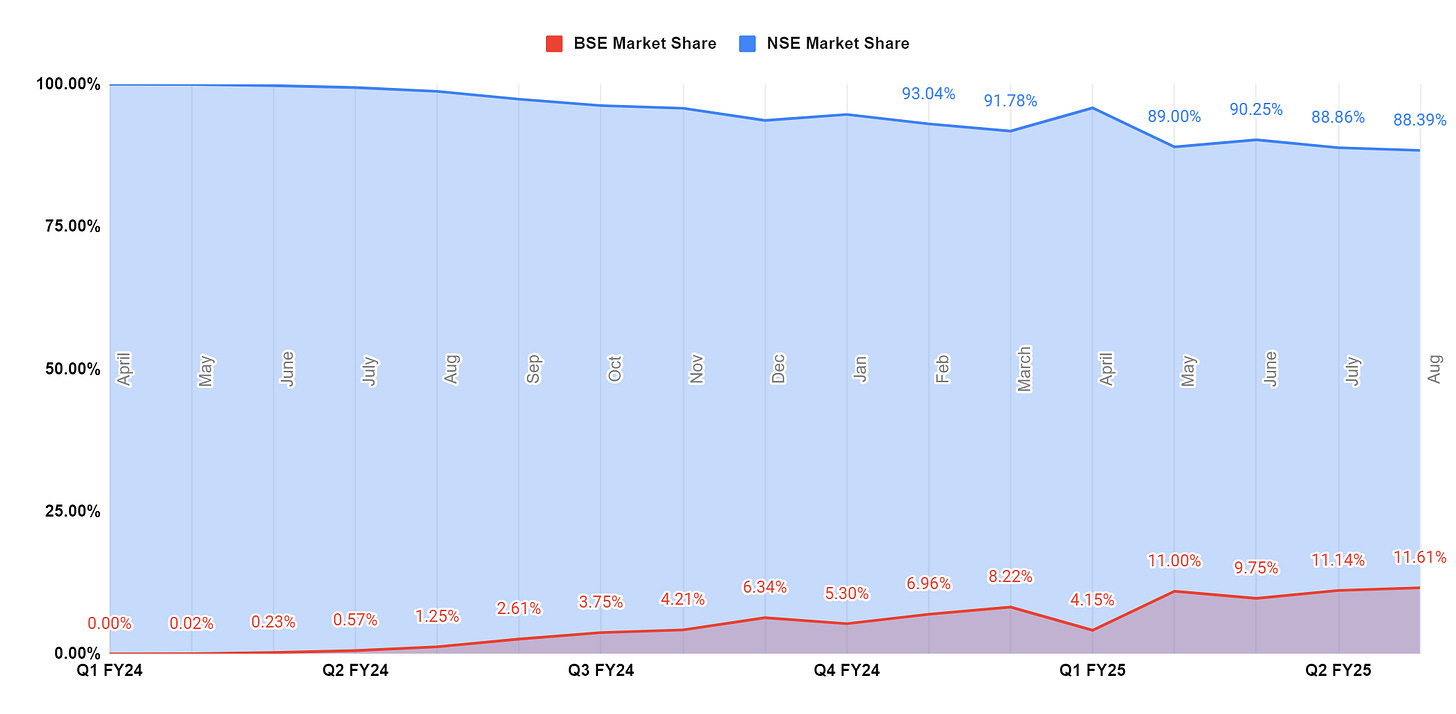

The activity picked up gradually as more and more brokers got onboarded. Below image depicts the growth in average daily options premium turnover on a month on month basis.

Going forward, the turnover is expected to increase due to network effects that will come into play. As the market stabilizes and traders across categories get the required confidence, more capital will get allocated to the BSE derivatives segment.

BSE is gaining market share every month when compared to NSE’s option premium turnover. It's not that NSE’s activity is falling but the overall market itself is expanding and BSE is being successful in gaining market share in the incremental market.

SEBI’s blessing in disguise ?

SEBI issued a circular in July 2024 enlisting measures and steps to protect retail investors from F&O by inviting comments from stakeholders. The circular recommends restricting weekly expiry to one index per exchange. Currently, NSE has weekly expiries on four indices vs two for BSE. After the circular comes into force, NSE & BSE will both have to restrict weekly expiry to only one index. Bank Nifty weekly expiries contribute significantly to NSE’s operations and profitability. This will dent NSE’s market share and may in fact be positive for BSE as BSE will see increased activity due to capital shifting from other weekly expiries to BSE’s SENSEX expiry on Friday as traders will have limited indices to trade for weekly expiries.

Below image depicts the market share that has been achieved by BSE since re launching its options segment :

In the options segment, BSE earns revenue from transaction charges which are billed to brokers who in turn charge it to the actual buyers and sellers. BSE was charging very less fees as compared to NSE but after SEBI order (to compute SEBI’s fees on notional turnover and not option premium), BSE had to revise its charges from INR 2000 per crore to INR 2950 per crore of option premium turnover for brokers with monthly premium turnover of more than INR 2000 crore. Now the discount with NSE for this category of brokers has narrowed down significantly. NSE’s charges are INR 3000 per crore. Following this revision, options' notional turnover on the BSE declined over the subsequent two weeks. However, it has since resumed the trajectory, indicating robust momentum in option trading that persists. It would be interesting to see if there is any longer term impact on turnover because of the increase in charges.

For Q1 FY25, the average daily premium turnover has been INR 7,180 crore. In Q4 FY24, the same was INR 4,800 crore. There has been growth of 49.5% on a QoQ basis.

If we assume growth of 12% for Q2, daily option premium turnover will be INR 8,050 crore and if 15% is assumed then it will be INR 8,227 crore. We believe the base of Q1 was higher due to exit polls and election results. Lets calculate the revenue that BSE will earn on this option premium turnover :

BSE will charge revised transaction charges of INR 2950 crore per crore to the broker and assuming all brokers onboarded have monthly premium turnover upwards of 2000 crore with BSE.

In Q4 FY24, BSE made a provision of INR 169 crore to pay SEBI Turnover charges retrospectively up to December 2023. Subsequently, in Q1 FY25, it added the expense for the quarter separately in P&L which was 82 crore.

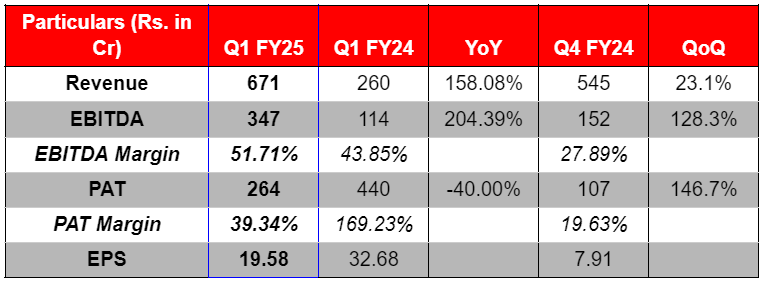

BSE revenue grew by 158% and EBITDA by 304.5% on YoY basis during Q1 FY25. The main reason has been explosive growth in the derivative segment resulting in operating leverage. Other segments such as the legacy business also showed 15% plus growth.

In Q1 FY25, BSE’s revenue from its mature legacy business and other operations excluding derivatives was INR 461 crore and that from Investment Income was INR 62 crore. If we assume no growth in legacy business and Investment Income of INR 50 crore, the total revenue for Q2 FY25 can be INR 805 crore.

If we assume 52% margins recorded in Q1FY25 to remain constant without taking into account the operating leverage that may kick in with the rise in options turnover, operating profit of BSE for Q2 can be ~INR 419 crore. We can now calculate the PAT as follows :

Current Market Cap of BSE is INR 38,700 crore. If we annualize this quarterly profit without factoring in future growth, total profit will be INR 1,225 crore. Then BSE trades at P/E multiple of 31.5.